The first quarter of the year… of course I was excited to get started and to start the year with a bang!

We were taught a second strategy, an expanded version of the first one. What made it more difficult was it required me to actually confront my demons.

When is enough, enough for me? What is my risk appetite? Would I rather get the sure 400 pips, or the (unsure) 2000 pips?

The answers to these questions differ from trader to trader. And I needed to find what worked for me.

KEY TAKEAWAYS

Disclosure: This post may contain affiliate links, meaning if you decide to make a purchase through my links, I may earn a commission at no additional cost to you. See my disclosure for more info.

Table of Contents

Overview of the Trading Experiment

- Approach Taken: I use technical analysis (support and resistance), no indicators, no bots, and no news. My broker is Hot Forex (HFM) and I use MT4 on my Android phone and desktop computer.

- Initial Setup: My starting capital is $200. I trade XAU/USD, like all Leo Advantage students, and trade in H1 (hourly) timeframe.

- Trading Strategy: Swing trading.

- Target: 20% of my trading account net profit from Forex trading.

All My Fx Trading Progress Reports

New to my journey? Find out why I’m doing a Forex Trading Experiment here.

Here are the links to the rest of my quarterly progress reports.

Annual progress reports:

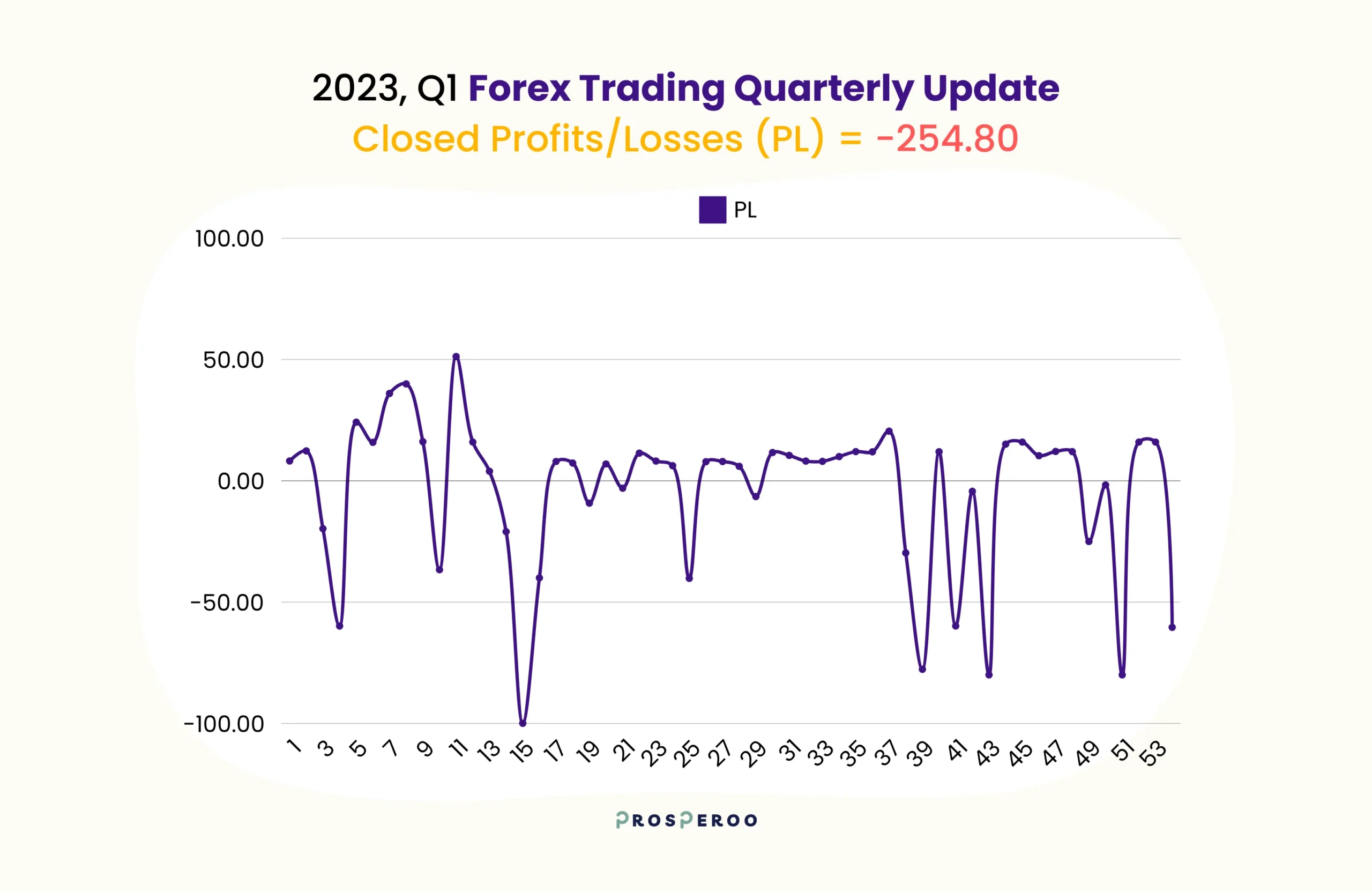

Performance Summary for 2023, Quarter 1

- Closed P/L (Profit/Loss): -$254.80

- Total Trades Executed: 54

- Target: Earn 20% of my trading capital per month.

- Comparison with Expectations: Ended the quarter with -$254.80 profit.

| Profit | Loss | |

|---|---|---|

| Largest | $52.20 | -$99.95 |

| Average | $14.08 | -$40.10 |

| Consecutive | 9 | 3 |

This quarter wasn’t as successful as I’d hoped in my trading journey. I ended with a closed profit/loss of -$254.80, falling short of my monthly goal of earning 20% of my trading capital. I executed a total of 54 trades, but despite the effort, the results were not in my favor.

My largest profit was $52.20, while my largest loss reached -$99.95. On average, my profits were $14.08, and my losses averaged -$40.10. I did manage a positive streak of 9 consecutive wins, but overall, I still ended in the negative.

It’s a reminder that the market can be unpredictable, and I need to refine my strategy moving forward to better align with my targets.

Zooming Out: Performance from the Beginning

[add]

Lessons Learned

- Having a strategy is not the be-all and end-all of trading. It’s just one part. 5 years ago, I had one mentor who scoffed at people who teach trading psychology. It’s one of the things I had to unlearn. Psychology is the most important.

- I need to find my risk appetite so I can tailor my next trades based on it. Or it will be an uphill battle.

- Just because I trade a lot doesn’t mean I’ll also earn a lot. More exposure to the market is a double-edged sword.

- Many of my trades are revenge trades. I entered them just so I could make back what I lost.

- I can make back what I lost—I don’t have to do it within the same day. It’s my ego talking. I didn’t want to be “wrong.”

- Money really is emotionally charged—and I need to understand my relationship with money.

Challenges and Drawbacks

- Difficult Trades: There were days when I placed 3 to 4 trades. And I ended up stressed, with negative or even breakeven results.

- Mistakes Made: Revenge trading—and I wasn’t even aware of it.

- Adjustments Needed: Catch myself before I revenge trade. Only trade once a day.

Plan for Next Quarter

- Adjustments to Strategy: Only 1 trade per day.

- Goals for the Next Quarter: Stop trading when my quota is hit, be consistent with journaling my trades, and analyze and learn from past trades.

- Things to Focus On: Backtesting and improving my trading psychology through journaling.

All My Fx Trading Progress Reports

New to my journey? Find out why I’m doing a Forex Trading Experiment here.

Here are the links to the rest of my quarterly progress reports.

Annual progress reports: