Whew, finally back in the black! This quarter in forex was a rollercoaster, though. I started strong, then basically handed my wins back to the market in the last month.

Turns out, adapting to shifting market conditions is tougher than I thought, and my “freeze under pressure” personality definitely showed in my trading.

But hey, I learned a TON. I dug deep into what went wrong and came up with a plan to tackle those next quarter.

Want to see the nitty-gritty details and how I’m prepping for next quarter? Check out my full report below!

KEY TAKEAWAYS

Disclosure: This post may contain affiliate links, meaning if you decide to make a purchase through my links, I may earn a commission at no additional cost to you. See my disclosure for more info.

Table of Contents

Overview of the Trading Experiment

- Approach Taken: I use technical analysis (support and resistance), no indicators, no bots, and no news. My broker is Hot Forex (HFM) and I use MT4 on my Android phone and desktop computer.

- Initial Setup: My starting capital is $200. I trade XAU/USD, like all Leo Advantage students, and trade in H1 (hourly) timeframe.

- Trading Strategy: Swing trading.

- Target: 20% of my trading account net profit from Forex trading.

All My Fx Trading Progress Reports

New to my journey? Find out why I’m doing a Forex Trading Experiment here.

Here are the links to the rest of my quarterly progress reports.

Annual progress reports:

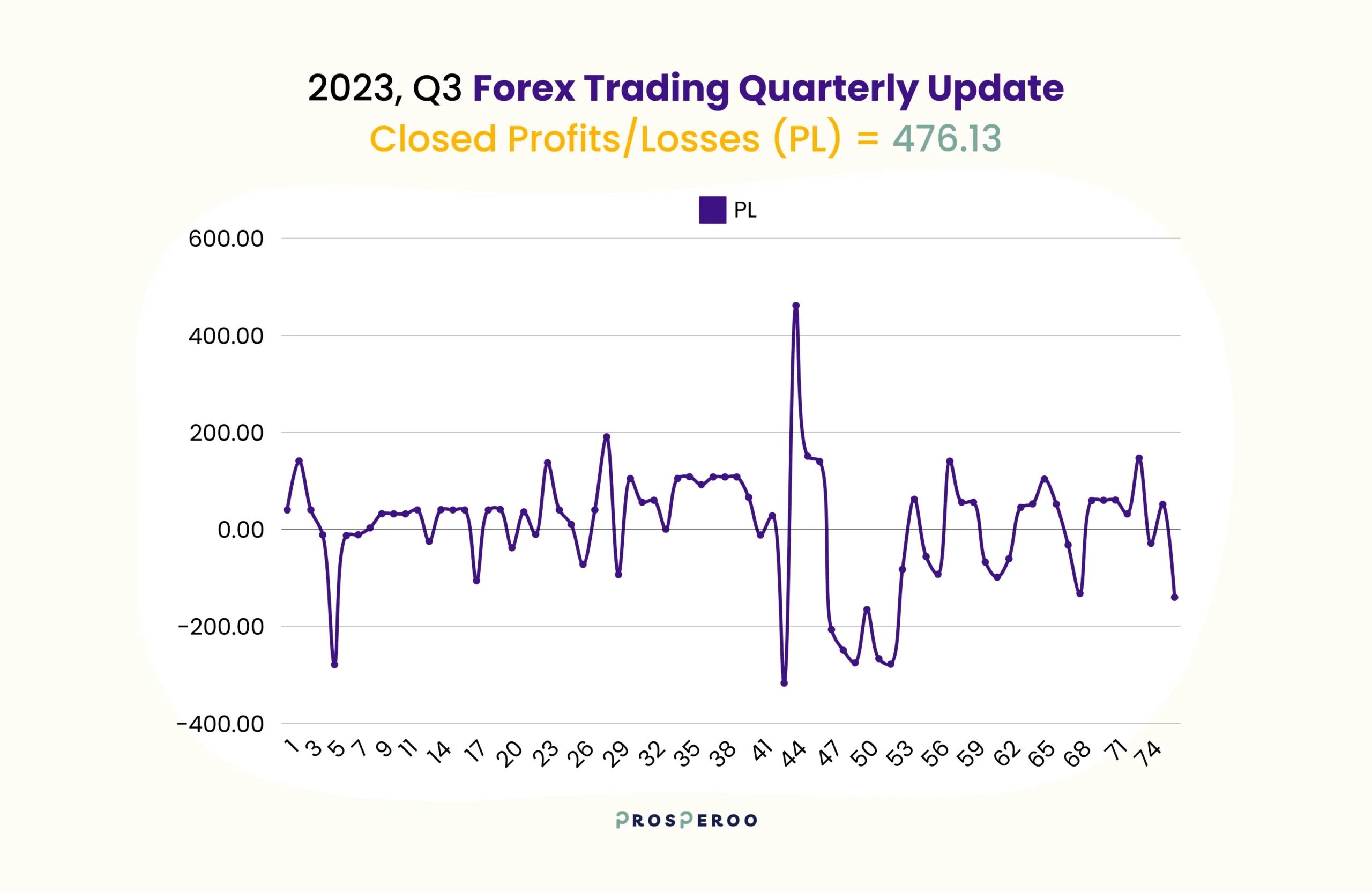

Performance Summary for 2023, Quarter 3

- Closed P/L (Profit/Loss): $476.13

- Total Trades Executed: 76

- Target: Earn 20% of my trading capital per month.

- Comparison with Expectations: Ended the quarter with $476.13 profit.

| Profit | Loss | |

|---|---|---|

| Largest | $461.52 | -$316.80 |

| Average | $76.94 | -$114.89 |

| Consecutive | 11 | 7 |

This latest quarter, things took a much more positive turn. I closed out with a profit of $476.13, which felt like a step in the right direction toward my goal of earning 20% of my trading capital per month. I executed a total of 76 trades, and thankfully, this time around, the results were more in my favor.

The biggest win this quarter was $461.52, which was a real boost to my morale. On the downside, my largest loss was -$316.80—a tough pill to swallow, but at least I managed to balance things out in the end.

My average profits came in at $76.94, while my average losses were -$114.89. The most encouraging part was achieving a streak of 11 consecutive wins, which definitely helped my confidence.

Compared to the previous quarter, this one was a huge improvement. It was great to see my adjustments paying off and finally ending up in the green.

The profits this time gave me a much-needed push, and it’s proof that sticking with it and learning from the tough times can lead to a turnaround. There’s still a lot to work on, but I’m feeling more optimistic and ready to keep moving forward.

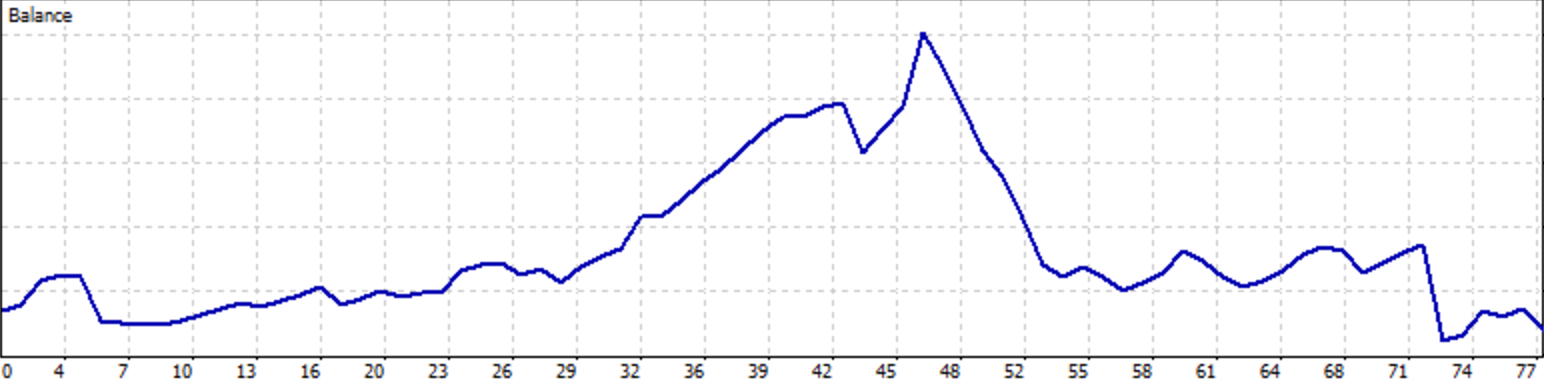

Zooming Out: Performance from the Beginning

[add]

Lessons Learned

- Despite a positive outlook in the quarterly recap, looking at my performance in the last month of this quarter is a big blow. I basically gave my wins back to the market.

- They say, “The trend is your friend until it bends.” I did the former and rode the trend, but struggled with the latter.

- The trend changed, and I struggled to accept that it changed. I was looking for sell signals when the market had already stopped the downtrend and was already going up.

- Our trading mentors always say that we need to trade what we see, not what we think should happen. It’s easy to memorize this, but to apply this in the thick of things is a challenge.

- Really, the only way to get good at this game is to actually play the game.

- I learned a lot about myself—my relationship and how I approach and react to change in general, for instance—and it made me realize that I have many things I need to work on.

Challenges and Drawbacks

- Difficult Trades: Trading an uptrend after weeks of downtrend—I struggled with buy trades after weeks of putting sell trades.

- Mistakes Made: Not trading what I see, but what I think the market should do.

- Adjustments Needed: Adapt to changing market conditions.

Plan for Next Quarter

- Adjustments to Strategy: Only 1 trade per day.

- Goals for the Next Quarter: Consistent journaling to spot patterns in my approach.

- Things to Focus On: Understand and accept the limitations of the trader and the trading strategy.

All My Fx Trading Progress Reports

New to my journey? Find out why I’m doing a Forex Trading Experiment here.

Here are the links to the rest of my quarterly progress reports.

Annual progress reports: