For the second quarter, I was determined for a comeback. But I was zoomed in. I was so focused on what I was doing on the daily grind that I missed the bigger picture.

KEY TAKEAWAYS

Disclosure: This post may contain affiliate links, meaning if you decide to make a purchase through my links, I may earn a commission at no additional cost to you. See my disclosure for more info.

Table of Contents

Overview of the Trading Experiment

- Approach Taken: I use technical analysis (support and resistance), no indicators, no bots, and no news. My broker is Hot Forex (HFM) and I use MT4 on my Android phone and desktop computer.

- Initial Setup: My starting capital is $200. I trade XAU/USD, like all Leo Advantage students, and trade in H1 (hourly) timeframe.

- Trading Strategy: Swing trading.

- Target: 20% of my trading account net profit from Forex trading.

All My Fx Trading Progress Reports

New to my journey? Find out why I’m doing a Forex Trading Experiment here.

Here are the links to the rest of my quarterly progress reports.

Annual progress reports:

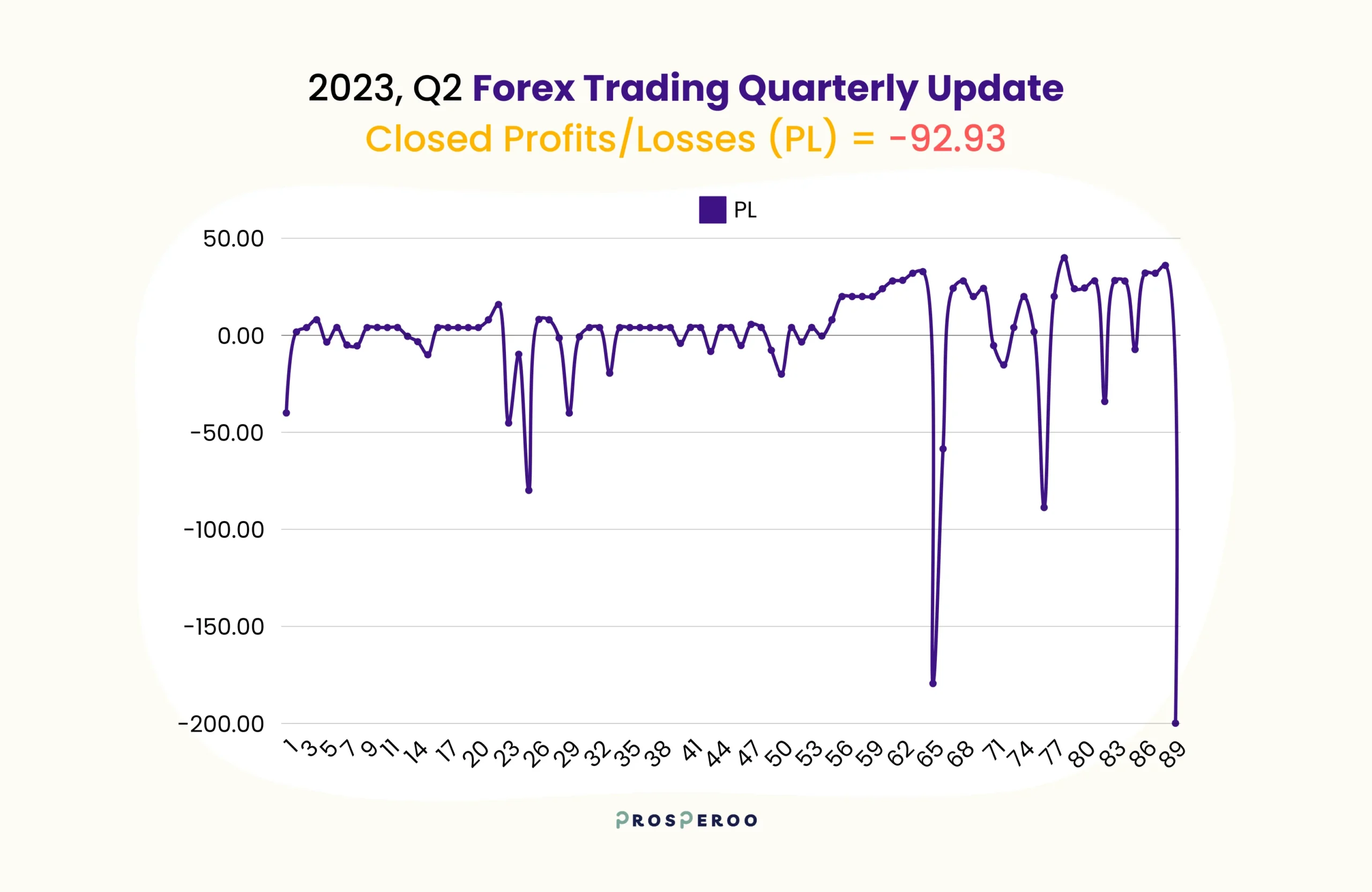

Performance Summary for 2023, Quarter 2

- Closed P/L (Profit/Loss): -$92.93

- Total Trades Executed: 89

- Target: Earn 20% of my trading capital per month.

- Comparison with Expectations: Ended the quarter with -$92.93 profit.

| Profit | Loss | |

|---|---|---|

| Largest | $40 | -$199.90 |

| Average | $13.47 | -$31.06 |

| Consecutive | 10 | 3 |

This quarter was a bit of a rollercoaster, and unfortunately, I didn’t end up on the high I was aiming for.

I closed out with a profit/loss of -$92.93—definitely not the outcome I was hoping for, especially given my goal of earning 20% of my trading capital each month. I threw myself into 89 trades, but despite all that effort, the results just weren’t on my side this time around.

There were some wins, of course. My largest profit was $40, which felt like a small victory, but my biggest loss stung at -$199.90.

On average, my profits were $13.47, while my average losses were -$31.06. The highlight was a streak of 10 consecutive wins, which gave me a much-needed confidence boost. Still, in the grand scheme, I ended in the red.

If there’s one thing this quarter reminded me, it’s that the market has a way of keeping you humble. I need to shake off the losses, tighten up my strategy, and come back sharper next quarter. The ups and downs are all part of the journey, and I’m ready to learn from them and keep pushing forward.

Zooming Out: Performance from the Beginning

[add]

Lessons Learned

- My trading psychology was in tatters. I struggled to accept my losses. I attached losing to myself and my ego pushed back. Growing up, I always got compared to other kids doing better than me. I grew up in a home with helicopter parents. I struggled with making mistakes and being okay with them. It’s something I need to heal.

- I did revenge trading again. I noticed that I did it without even thinking—it was on autopilot. But emotions were high while I was doing it. I need to break the habit.

- I fell into superhero syndrome after consecutive wins. So imagine a trader who thinks they’re invincible, like a superhero. They take huge risks, move their stop-loss orders, and think they can predict every market move. They basically believe they can’t lose! That’s “superhero syndrome” in trading. And it’s a recipe for disaster. Even the most successful traders still lose. And that’s okay, and that’s to be expected.

- I need to be okay and at peace with the knowledge that I can make back what I lost ultimately. But it doesn’t have to happen in a single day. It will happen one properly executed trade at a time.

- Being wrong is okay. What you do after is what makes all the difference.

Challenges and Drawbacks

- Difficult Trades: There were days when I placed 5-6 trades in one day. And I ended up stressed, with negative or even breakeven results.

- Mistakes Made: Revenge trading—on autopilot! Resulted in a disaster.

- Adjustments Needed: Catch myself before I revenge trade. Only trade once a day.

Plan for Next Quarter

- Adjustments to Strategy: Only 1 trade per day.

- Goals for the Next Quarter: Stop trading when my quota is hit, be consistent with journaling my trades, and analyze and learn from past trades.

- Things to Focus On: Backtesting and improving my trading psychology through journaling.

All My Fx Trading Progress Reports

New to my journey? Find out why I’m doing a Forex Trading Experiment here.

Here are the links to the rest of my quarterly progress reports.

Annual progress reports: